Inflation - a reading list

In 2022, every euro in the Netherlands lost about 10% of its value, price increases comparable to the stagflation period of the 1970s. In the same year, the value of the Argentine peso halved, while prices in China only rose by 2%. How well do we understand the economic mechanisms behind inflation? Can inflation be controlled? And what lessons can we learn from the past?

This reading list contains well-thought-out scholarly works on monetary policy that can provide insight into the economic causes and effects of inflation. But the consequences of inflation are much broader than just economic. Crises due to inflation, or even hyperinflation, have historically caused great cultural and social upheaval. How did Germans cope with the hyperinflation of the late 1920s? And how did Zimbabwe deal with the protracted period of inflation that started in 2007? The economic discussion about inflation also has an important political component. Surely things shouldn't be able to get this out of control in a globalized economy with data-driven central banking policy?

The books in this reading list can all be borrowed from Leiden University Libraries (UBL). To borrow the book, follow the link below the title. The UBL has many more books that have something to do with inflation. Search the Catalogue yourself by title, author or keyword.

P. Bernholz, Monetary regimes and inflation: history, economic and political relationships

2015

Why does inflation occur, what are its effects on society, and what can authorities do to curtail it? To answer these questions, Peter Bernholz goes back in time to reconstruct cases of moderate and extreme inflation from Roman times to the present. In particular, he compares thirty cases of hyperinflation in the nineteenth- and twentieth centuries to find several regularities that help explain the start, escalation and end of periods of hyperinflation. His work argues that hyperinflationary periods are, for example, caused by governments with large spending deficits and policies that cause depreciation of money and distortion of exchange rates. But, Bernholz not only assigns a large role to authorities and policymakers in causing hyperinflation; they can also prevent and end it. And the same holds for moderate or high inflation. Central to these efforts, according to Bernholz, are two things: that central banks remain independent and that exchange rates remain fixed. By delving into the history of inflation, seeking patterns from historical case studies and focusing on the role of governments in causing and curbing inflation, Bernholz provides a great starting point for reading up on the history, causes and effects of inflation.

C.M. Reinhart & K.S. Rogoff, This Time Is Different: Eight Centuries Of Financial Folly

2009

Times change, locations differ, and the actors involved come and go, but financial crises have remained roughly the same in appearance over the centuries. This thesis by leading economists Reinhart and Rogoff is based on a huge amount of data, spanning crises from medieval currency depreciations to the 2008 housing crisis. The book exposes hitherto hidden macroeconomic processes by means of thorough data analysis, but also delves into history, politics and psychology to further explain the economic processes behind inflation. It's not often that an elaborate academic work full of graphs and empirical evidence becomes a bestseller, but the urge for explanation among a wide audience after the 2008 financial crisis gave this study all the attention it deserved.

G. Kararach & R.O. Otieno, Economic Management in a Hyperinflationary Environment: The Political Economy of Zimbabwe, 1980 – 2008

2016

After the economic crisis of 1929 and accompanying hyperinflation in Germany, Zimbabwe is perhaps the best-known case of hyperinflation. At the end of the first decade of the millenium, money became worthless within days of printing, and hyperinflation spiraled to such a point that there was no longer enough space to print all the necessary zeros on the currency. This work focusses on the Zimbabwan crisis, but rather than focusing on the reasons for hyperinflation, Economic Management in a Hyperinflationary Environment provides an overview of the various economic actors in the country and how they coped with and adapted to this economic crisis. It begins with an accessible summary of Zimbabwe’s political economy from independence until 2008 in its introduction, before moving on to more detailed analysis of the different sectors of the Zimbabwean economy. By demonstrating the impact of hyperinflation and the responses to it by public and private sectors – but also households – this book is a compelling read for anyone interested in the effects of hyperinflation on society.

B. Bernanke, T. Laubach, F.S. Mishkin, & A.S. Posen, Inflation Targeting: Lessons from the International Experience

1999

How should governments and central banks use monetary policy to create a healthy economy? Traditionally, policymakers have used such strategies as controlling the growth of the money supply or pegging the exchange rate to a stable currency. In recent decades a promising new approach has emerged: publicly announcing and pursuing specific targets for the rate of inflation.

Written by a team of experienced economists, the book covers the practical aspects of implementing a so-called 'inflation targeting regime', its strengths, and its limitations. It is divided into two parts. The first provides a theoretical framework for understanding inflation targeting and its benefits. The authors argue that this approach is an effective monetary policy tool that can help central banks achieve price stability and anchor inflation expectations. They also discuss the challenges associated with implementing an inflation targeting regime, such as the difficulty of accurately measuring inflation and the potential trade-offs between price stability and other macroeconomic objectives.

The second part of the book examines the experiences of several countries that have adopted inflation targeting, including New Zealand, Canada, the United Kingdom, Sweden, Australia, and Israel. The authors provide a detailed analysis of the policy frameworks, institutional arrangements, and operational procedures that these countries have used. Finally, they argue that the U.S. Federal Reserve and the European Central Bank should adopt this strategy, and they make specific proposals for doing so.

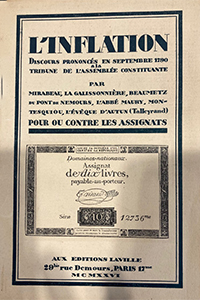

B.A.B. de Beaumetz et.al., L' Inflation : Pour ou contre les assignats. Discours prononcés en septembre 1790 à la tribune de l'Assemblée constituante

1926

After the French Revolution the government confiscated land that had belonged to the church. Assignats were a form of paper money backed by these lands, brought into circulation in the turbulent period immediately after the Revolution. Trust in assignats was weak, as the amount of bills exceeded the amount of properties backing them, and counterfeiting was easy. The value of assignats, therefore, declined sharply with falling trust. This book contains discourses about the assignats problem from Parliament, one of them pronounced by Honoré-Gabriel Riquetti, Comte de Mirabeau, who despite his peerage chose for the revolution and who in 1791 was the first to be buried in the Panthéon. Three years later, however, he was removed from his resting place, when suspicions about his revolutionary inclinations were roused after his correspondence with Louis XVI was discovered.

The issue of inflation was also a theme for the masses, as is proven by a popular song of that time: 'Here I have my assignats | here in my snuffbox, see! | Here I have my assignats | Who will give cash for them to me?'

R. Brunngraber, T. Lange & K. Ziak, Karl und das 20. Jahrhundert: Roman

1978

Rudolf Brunngraber (1901-1960) wrote the novel Karl and the Twentieth Century in 1932. Its hero Karl Lakner is exposed to all the hardships that an Austrian could endure between 1983 and 1931: war, unemployment, hunger and of course the economic crisis and inflation of the twenties. Writers are usually expected to bring their characters alive by their imagination and style. Brunngraber deliberately keeps Karl as colourless as possible. He is a naturalistic kind of Everyman, the modern man in the crowd, crushed by the blind forces of war, politics and economy. His story is constantly interrupted by numbers and fact that seem to have been lifted directly from newspapers and official reports.

This interesting writing style yields sentences like this: “On this morning, Karl for the first time reached for alcohol before he climbed the tower with is instruments. At the same time, grand prince Nikolaj Nikolajevič and the 30th field corps broke through the area between Warsaw and Ivangorod, forcing the offensive armies again to retreat to the Silesian border.”

Contact us

Is an important work on inflation missing on this list? Leave your suggestions with us on Twitter, Facebook or Instagram. Would you like the UBL to purchase a work on inflation, not yet present in our collections? Contact us via Ask a Librarian.